**The objective of The Investment Editor’s Cut is to deliver distinguished, original, consequential analysis to investors. Investment performance ISN’T the primary goal. However, the IEC is not surprised that our selections perform well.

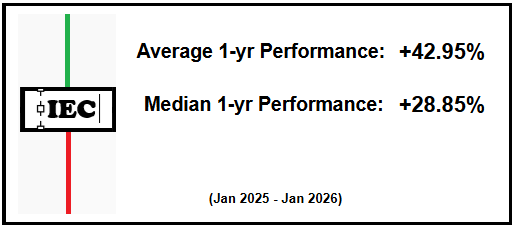

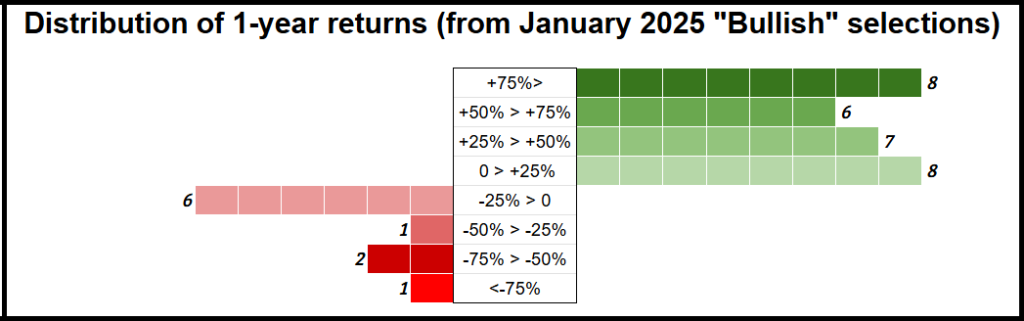

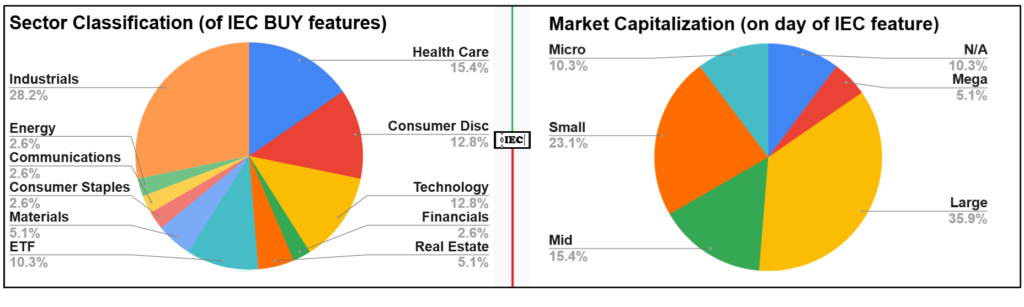

JANUARY One-Year Performance Deck

(from “Buy” recommendation reports featured in January 2025)

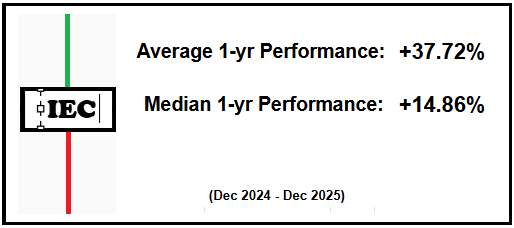

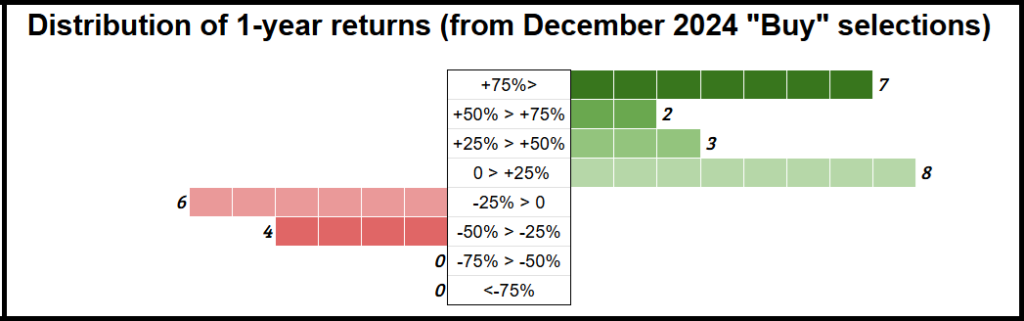

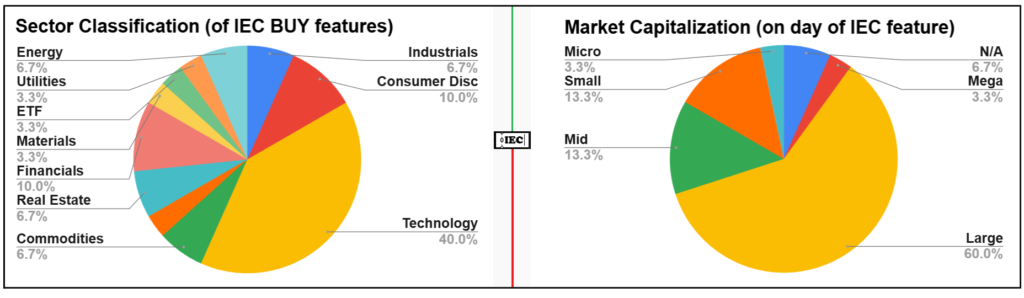

DECEMBER One-Year Performance Deck

(from “Buy” recommendation reports featured in December 2024)

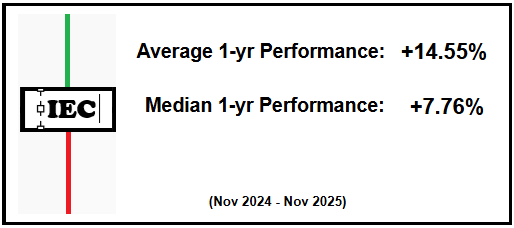

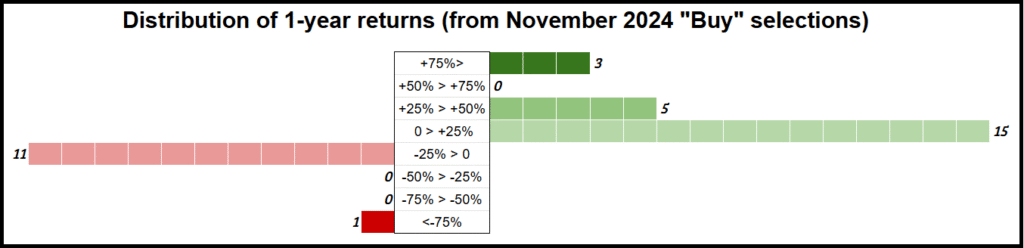

NOVEMBER One-Year Performance Deck

(from “Buy” recommendation reports featured in November 2024)

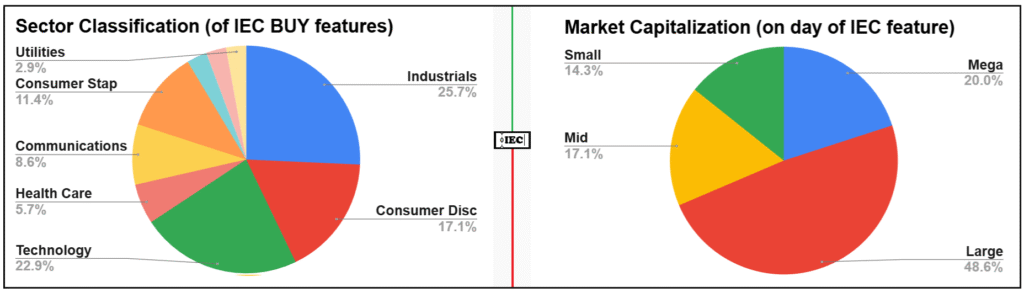

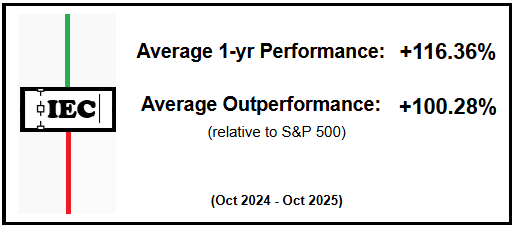

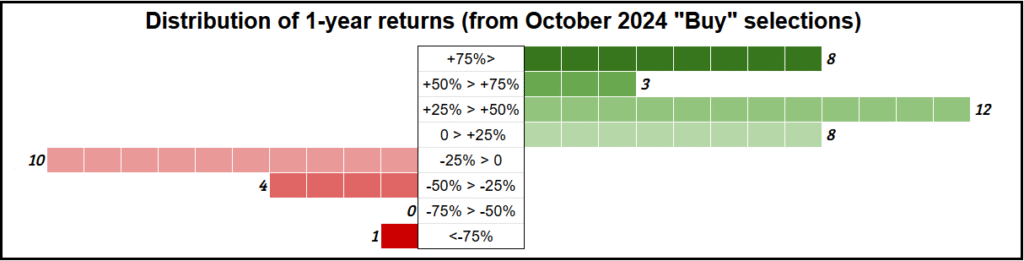

OCTOBER One-Year Performance Deck

(from “Buy” recommendation reports featured in October 2024)

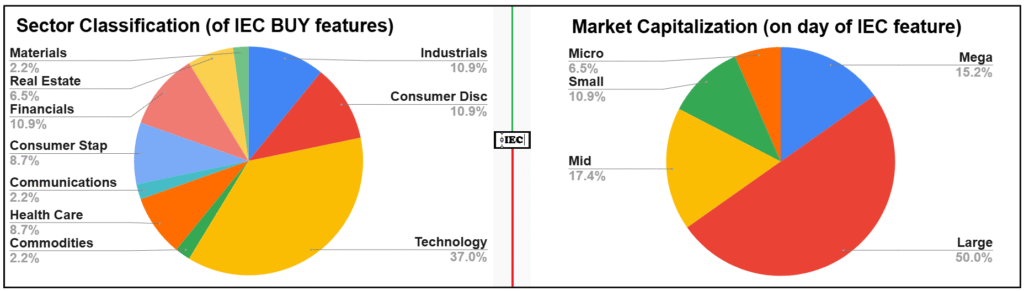

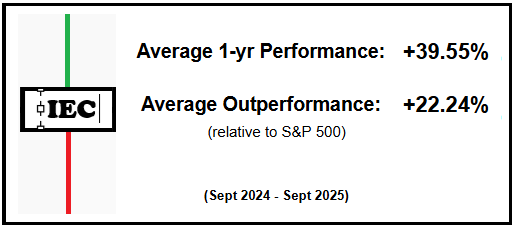

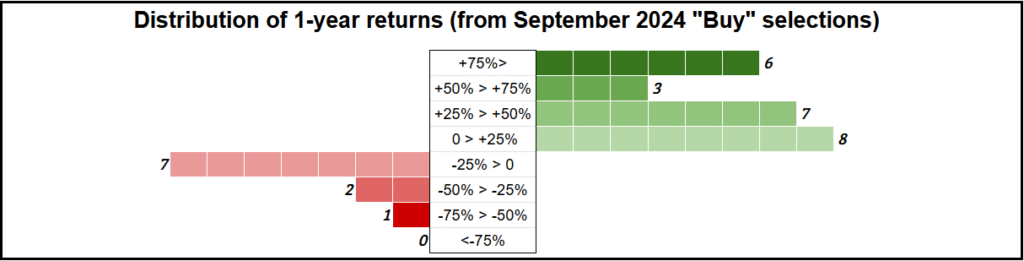

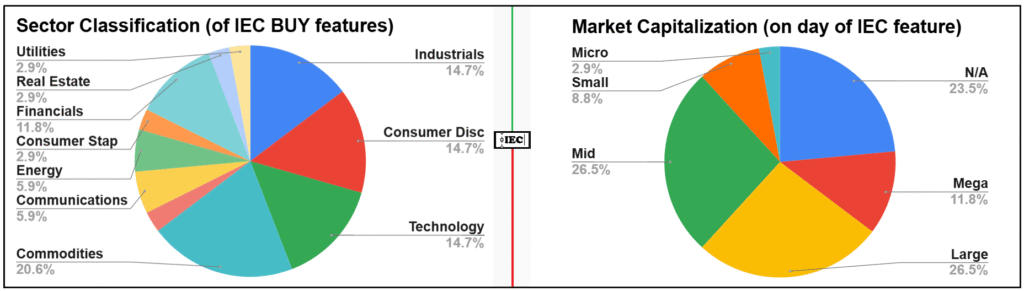

SEPTEMBER One-Year Performance Deck

(from “Buy” recommendation reports featured in September 2024)

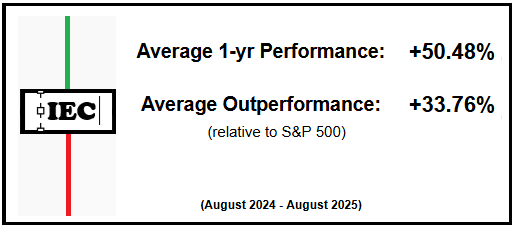

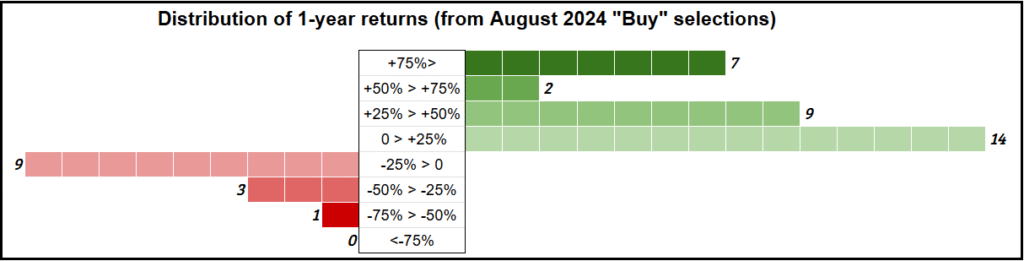

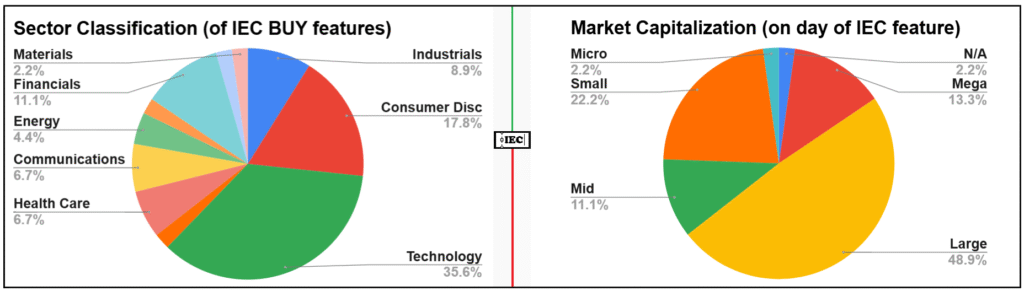

AUGUST One-Year Performance Deck

(from “Buy” recommendation reports featured in August 2024)

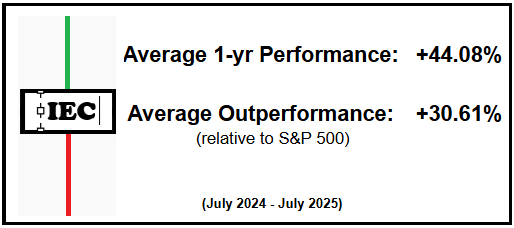

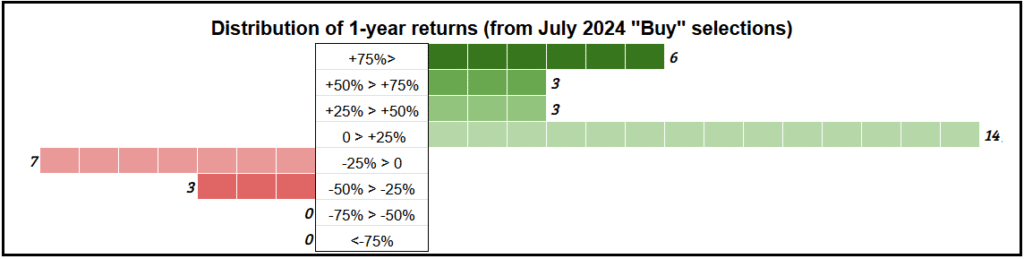

JULY One-Year Performance Deck

(from “Buy” recommendation reports featured in July 2024)

Disclosures:

- 1) Based on Long (Buy/Bullish) selections only. Short (Sell) recommendations are not included in the performance tracking and reporting presented above.

- 2) ”Beginning Price” / “Entry Price” is based on the time of original publication, not the time of selection for the Investment Editor’s Cut Daily Features, and sometimes an estimation occurs. Most investment ideas featured on the IEC were originally published same-day, or the prior day. Typically very little time (<10 hours of market trading time) has passed between original publication date, and the time of feature on the IEC.

- 3) Dividends are counted, but not dividend reinvestment profits.

- 4) Single investment reports that present multiple stock ideas are customarily excluded from performance tracking, with few exceptions. The intent is to track the performance of specifically ~deeper-dive analysis recommendations.

- 5) Investment recommendations are either explicitly stated in the investment publication, or carefully judged as implied.

- 6) Broad market views (features classified as “markets”) are not measured in the performance tracking. The performance tracking only reflects Buy/Bullish (Long) recommendations of single stocks, preferred shares, bonds, or segment ETFs exclusively.

- 7) Once selected for performance tracking, an article/ticker is never removed from the performance tracking. There is no retroactive changing of stock ideas being tracked for performance measurement.

- 8) Performance tracking of each selection is for a period of 1 year, and concludes after a period of 1 year. This is true regardless of whether an investment analyst may have changed their view of the investment security prior to the one-year anniversary of the selection. The IEC does not intend to be a resource for short-term trading ideas.

- 9) Where applicable, featured reports with only short-term recommendations are generally not selected for performance tracking. The IEC makes selection assessments using a long-term lens.

- 10) The heavy majority of investment recommendations are tracked using United States tickers, although numerous Canada-based tickers, and occasionally overseas tickers may serve to determine performance. Foreign currency movements may impact specific-currency returns.

Disclaimers:

- Performance calculations and presented results have not been audited.

- Given the delay between the original time of publication and the time of feature (see #2 above), commission charges, the impacts of foreign currency translation, and possible investor fees, the precise one-year profit performance calculated may not have been achievable for all securities for all investors.

- Past performance is no guarantee of future performance.

- Content featured on The Investment Editor’s Cut website or newsletter constitutes investment research and analysis, but does not constitute investment advice. Readers should consult with a professional financial advisor before taking any investment actions.

“Show me the incentive, and I will show you the outcome”

-Charlie Munger